malaysia rental income tax deductible expenses

Congress and signed into law by President Donald Trump on March 27 2020 in response to the economic fallout of the COVID disease. Rental income in Malaysia is taxed on a progressive tax rate from 0 to 30.

Special Tax Deduction On Rental Reduction Latest Updated 15 June 2020 Cheng Co Group

From stocks crypto to rental income TurboTax Premier has you covered.

. Excellent trip interruption coverage of 200 of the trip cost. Income Tax Act 1959 No. Estimates based on deductible business expenses calculated at the self-employment tax income rate 153 for tax year 2020.

5 A 12 Value Added Tax VAT is imposed on residential property leases that satisfy certain conditions. Expenses paid by tenant occur if your tenant pays any of your expenses. Lee the court ruled that there could be a corporate tax essentially saying the structure of business was a justifiably discriminatory criterion for governments to consider when writing tax legislation.

Costs for legal advice and documents that relate to rental activities are tax-deductible. For small and medium enterprise SME the first RM600000 Chargeable Income will be tax at 17 and the Chargeable Income above RM600000 will be tax at 24. Ps please give me contact details of a.

Stamp duty is the tax you pay your state or territory government when buying a property. Properties with rental payments exceeding PHP12800 US272 per month received by landlords whose gross annual rental income exceed PHP1919500 US40840 are subject to 12 VAT. End of example If youre not entitled to a GST credit claim the full cost of the business purchase including any GST as a deduction.

In fact some or all of your capital gain may be eligible for 0 tax if you fall within the 10 to 12 ordinary income tax bracket. The SME company means company incorporated in Malaysia with a paid up capital of. The domestic tax systems in the world may be grouped into eight broad families of income tax laws.

Pays for itself TurboTax Self-Employed. Actual results will vary based on your tax situation. Agent fees including advertising costs.

Rental Income Deductible Expenses. This was a unique ruling handed down during a unique time in US history that denied a corporation freedom it sought in the courtroom. Pays for itself TurboTax Self-Employed.

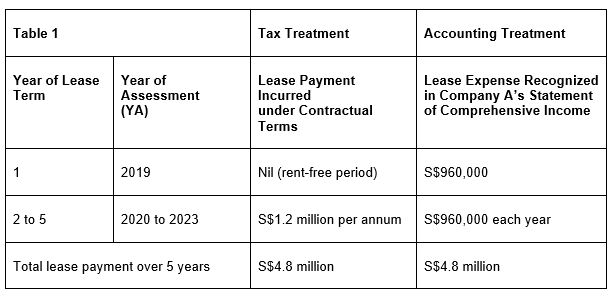

The VAT burden is generally shouldered by the tenants. Insurance is a means of protection from financial loss in which in exchange for a fee a party agrees to guarantee another party compensation in the event of a certain loss damage or injury. Example Company A entered into a lease agreement to rent an office space for 2 years with a monthly rental of 5000 for 2019 and 2020.

Stay in Malaysia less than 182 days are taxed at flat rate of 28 without. Online is defined as an individual income tax DIY return non-preparer signed that was prepared online either e. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021.

50 not more than 100000 THB. Prescribed expenditure of a personal nature is not deductible. For income tax purposes your company should claim tax deductions based on contractual rental payments regardless of how such expenses are recognised in its accounts.

The Coronavirus Aid Relief and Economic Security Act also known as the CARES Act is a 22 trillion economic stimulus bill passed by the 116th US. Cost of a company car driver related maintenance and insurance expenses provided by an employer provided that the car is owned or leased in the name of the employer and certain conditions ie. Donations to approved institutions or organisations are deductible subject to limits.

Then I would pay tax on my irish rental income and because i will be resident in thailand my state oap would go under the radar. Estimates based on deductible business expenses calculated at the self-employment tax income rate 153 for tax year 2020. However if you held onto the property for more than a year before selling it youre eligible for a.

Many of them follow a hybrid system which contains. Online is defined as an individual income tax DIY return non-preparer signed that was prepared online either e. For example your tenant pays the water and sewage bill for your rental property and deducts it from the normal rent payment.

Mortgage interest incurred to finance the purchase of a house is deductible only if income is derived from. Increases the amount of income tax you pay. The expenses that are income tax deductible including.

My support is about THB. Estimates based on deductible business expenses calculated at the self-employment tax income rate 153 for tax year 2020. But remember if you are a first home buyer many States.

Actual results will vary based on your tax situation. The expenses that are income tax deductible including. Income Tax Act 1959.

Under these systems certain countries have a single tax system for all taxpayers global system while other countries provide separate tax laws for different taxpayers and different items of income scheduler system. You must include them in your rental income. Unfortunately home buyers who plan to live in the property they buy cannot claim stamp duty as a tax deduction.

Stay in Malaysia less than 182 days are taxed at flat rate of 28 without. Business usage ratio mileage report etc prescribed under the Corporate Tax Law are met. Can owner-occupiers claim stamp duty.

How to report the sale of your foreign property You may not receive any statements or forms regarding the sale of your property or interest made such as 1099-INT or 1099-DIV so youll need to document the. Rental Income Deductible Expenses. 89 State additional.

Heres your guide to when a stamp duty tax deduction applies. The rental income commencement date starts on the first day the property is rented out whereas the actual rental income itself is assessed on a receipt basis. Very good travel delay coverage of 2000 per person after a 6-hour delay.

The spending primarily includes 300 billion in one-time cash payments to individual people who. You can deduct the expenses if they are deductible rental expenses. Alice can claim a GST credit of 2 on her activity statement and 20 as an income tax deduction on her tax return.

Top-notch coverage limits for medical expenses and evacuation. An entity which provides insurance is known as an insurer insurance company. Expenses you can immediately claim on a rental property 1.

Non-business expenses for example domestic or household expenses and taxes are not deductible. It is a form of risk management primarily used to hedge against the risk of a contingent or uncertain loss. I have closed my tax file in Malaysia when I relocated to Thailand.

This is to prepare for a possible audit by tax authorities in the future. The deadline for filing income tax in Malaysia also varies according to what type of form you are filing. Non-deductible expenses on the corporate tax return will.

Shall specify the currency or currencies in which the income and expenses are to be reported and may apply to all or to any specified activities of that person. This relief includes domestic travel expenses incurred during the period between March 1 2020 until December 31 2022--Before claiming the tax reliefs above remember to keep all proof of spending such as statements invoices and receipts.

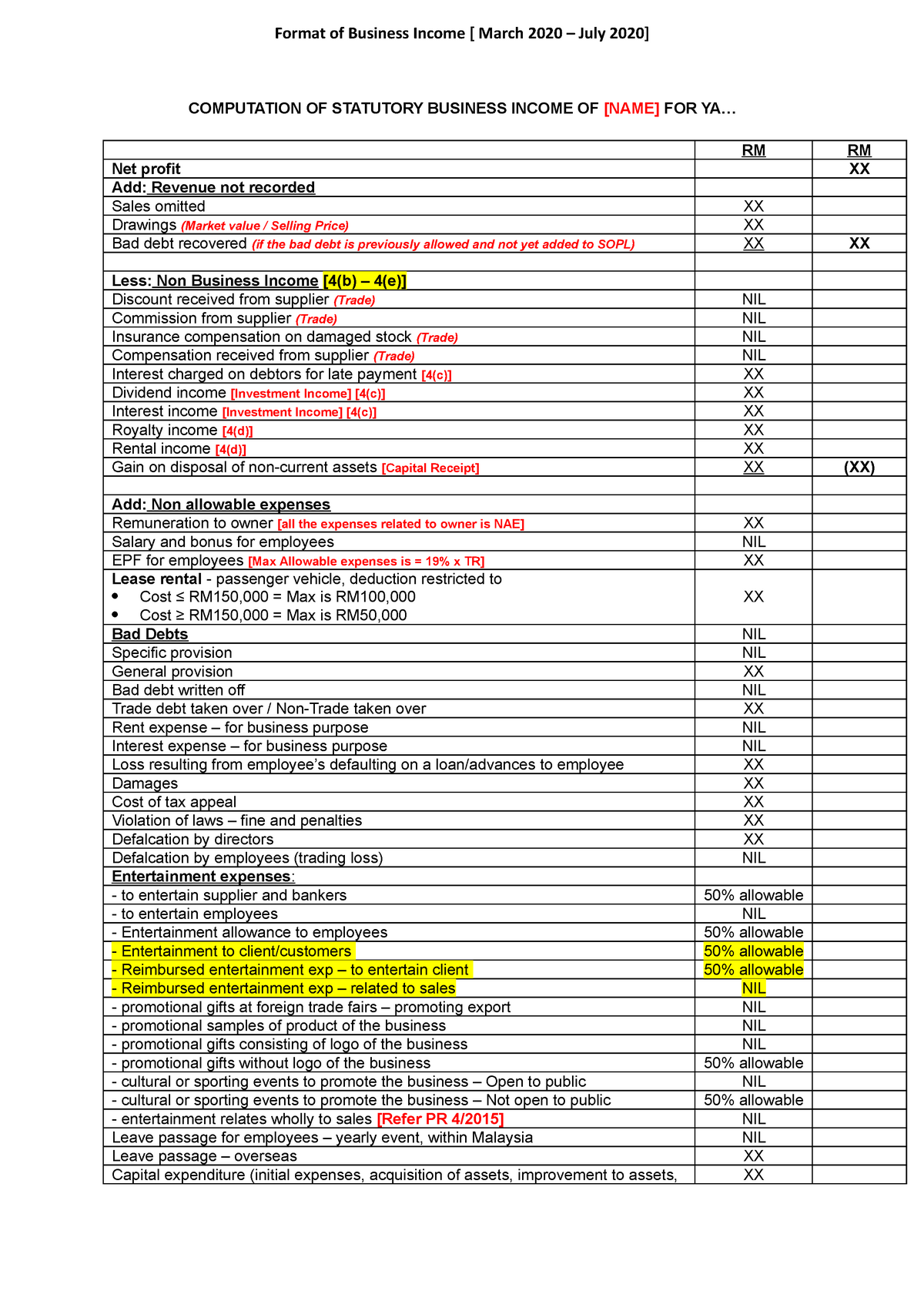

Business Income Format Of Business Income March 2020 July 2020 Computation Of Statutory Studocu

Malaysia Income Tax 2022 A Guide To The Tax Reliefs You Can Claim For Ya 2021 Buro 24 7 Malaysia

5 Things To Consider When Filing Taxes On Rental Income Free Malaysia Today Fmt

What Is An Investment Holding Company In Malaysia And 4 Benefits To Having One

Form 1116 Foreign Tax Credit Here S What You Need To Know Htj Tax

Expenses Related To Your Home Office Are Deductible Wolters Kluwer

How To Record Your Airbnb Income Expenses For Tax Purposes

All About Taxes On Rental Income Smartasset

Bursa Dummy Tax On Rental Income

Property Rental Income Deductible Expenses

Tax Treatment For Rental Of Business Premises Crowe Singapore

Rental Income Tax Complete Guide Ny Rent Own Sell

13 Business Expenses You Definitely Cannot Deduct

German Rental Income Tax How Much Property Tax Do I Have To Pay

Overview Of Slovak Real Estate Tax Rsm Consulting Sk

Solved Norman And Sarah Who Are Married Are Both Malaysian Tax Residents They Have An Eight Year Old Daughter Misha Details Of Norman S Employ Course Hero

Best Guide To Maximise Your Malaysian Income Tax Relief 2021

Qualified Business Income Deduction For Homeshare Hosts

.jpg)

Financing And Leases Tax Treatment Acca Global

0 Response to "malaysia rental income tax deductible expenses"

Post a Comment